Join as an agent

[ Acquisition Model ]

They own it

They own your business after purchase.

Corporate leadership makes strategic decisions, you operate under their branding, and you're locked in - you can't sell what you no longer own.

[ Software-Only Model ]

You own it, but not your identity

You own your business with complete autonomy and can sell anytime.

However, most agents end up using the IMO's or software platform's branding rather than building their own agency identity.

[ InsuraTec Model ]

You own everything

You own your business 100% - no equity stake, no buyout.

You make all strategic decisions, own your brand completely, can sell later (makes you MORE valuable), and keep your agency and book if you ever leave.

[ Acquisition Model ]

Corporate standard systems

Corporate standard systems (often legacy).

Limited customization due to IT standards, forced updates on corporate timeline.

[ Software-Only Model ]

Rigid platforms, patched solutions

Pre-built SaaS with very limited customization.

Need real functionality? Patch multiple solutions together (requires dev help, creates issues). Feature requests take 6-12+ months if they happen at all.

[ InsuraTec Model ]

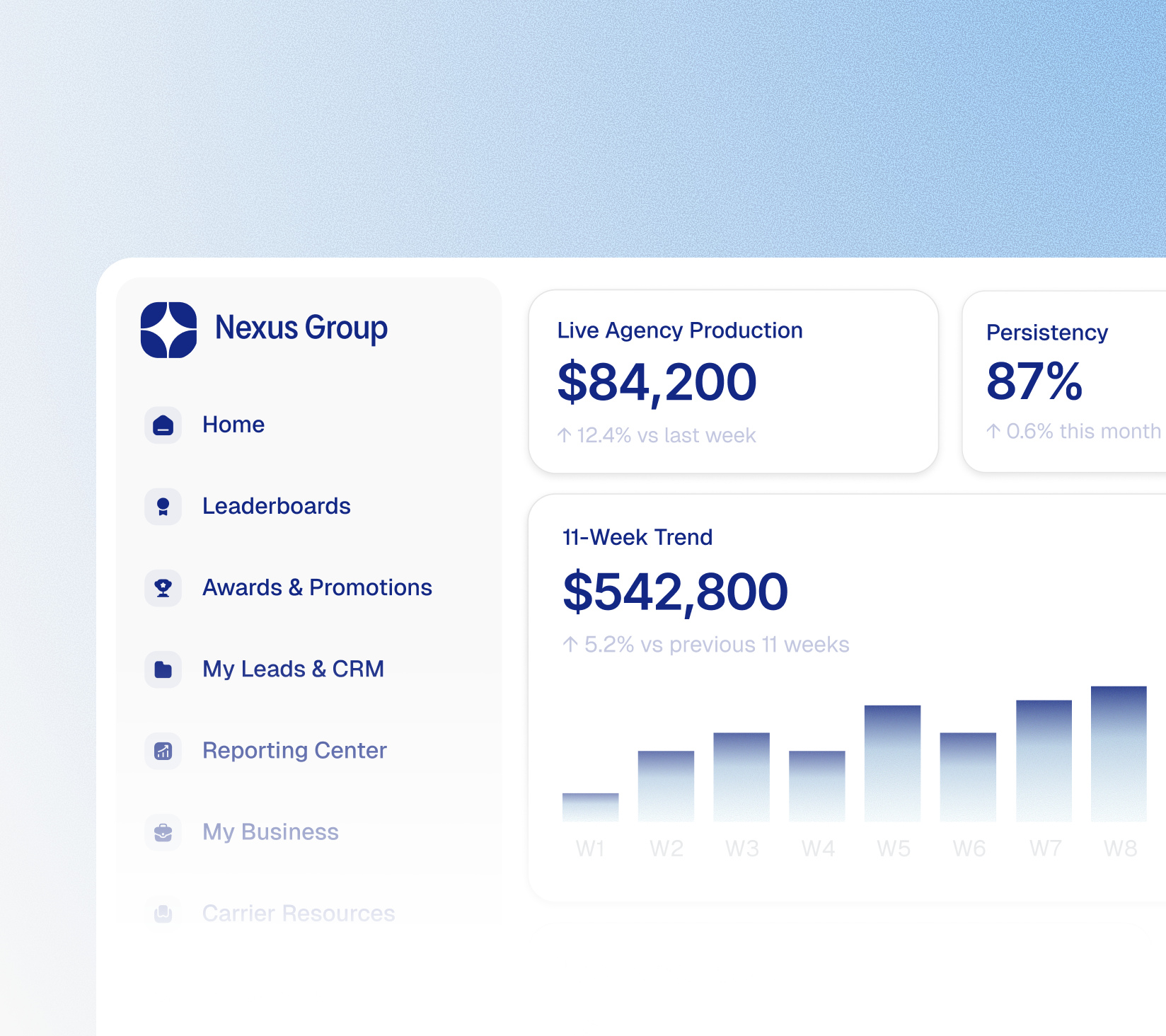

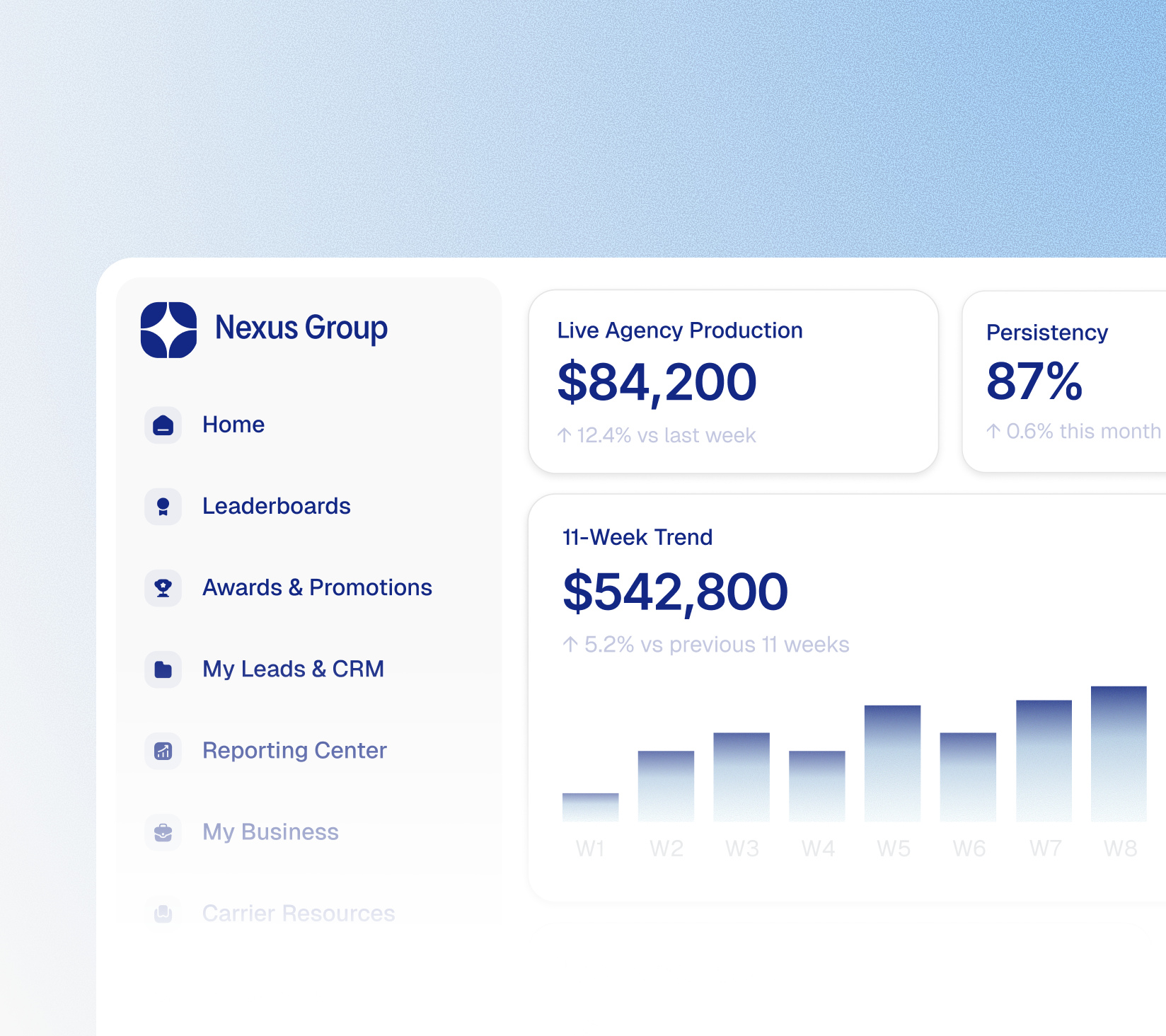

Technology built around you

Purpose-built, flexible technology that adapts to your workflow.

When you need specific functionality for growth, we work with you to accommodate it. Open integration with support, managed updates with input.

[ Acquisition Model ]

Enterprise access, corporate control

Access enterprise carrier relationships with top-tier commission rates.

Corporate handles contracting but controls which carriers you can access based on corporate priorities.

[ Software-Only Model ]

Locked out of top carriers

Most top carriers won't appoint you, they require substantial production minimums, years of track record, and infrastructure small agencies don't have.

Even if appointed, you get lower rates and handle all contracting yourself.

[ InsuraTec Model ]

Enterprise access, your control

Enterprise-level contracts and commission rates through our combined production volume.

We meet carrier criteria so you don't have to, manage contracting with dedicated support, and expand relationships based on needs.

[ Acquisition Model ]

Comprehensive but standardized

Corporate compliance, back-office, marketing templates, recruiting programs, and IT help desk.

Thorough and efficient but standardized - not tailored to your needs.

[ Software-Only Model ]

You're on your own

You handle everything: compliance, back-office, marketing, recruiting, training.

Hire your own expertise or build it all from scratch. Only get vendor support for software (quality varies, premium costs extra).

[ InsuraTec Model ]

Tailored infrastructure support

Proactive compliance guidance, integrated back-office support, marketing infrastructure you can customize, recruiting and development support, and dedicated account assistance.

[ Acquisition Model ]

Corporate-driven growth

Recruit into corporate (agents join parent company).

Geographic expansion and product lines subject to corporate strategy. Corporate systems handle scale automatically but on their terms.

[ Software-Only Model ]

Total freedom, total responsibility

Complete freedom to recruit, expand, and add products.

However, you must establish carrier contracts, compliance, and infrastructure in each new market. More business means more admin you build yourself.

[ InsuraTec Model ]

Strategic growth with support

Build your team your way with infrastructure that supports growth.

Expand with carrier contracts and compliance already in place. Product flexibility with infrastructure support. Systems scale with you.

[ Acquisition Model ]

Upfront cash, limited long-term upside

They pay you at acquisition, but corporate takes larger commission share over time.

Wealth captured at sale - future depends on employment contract. Post-acquisition "efficiencies" often reduce income.

[ Software-Only Model ]

Low entry, hidden costs add up

Monthly subscription ($100-500+) plus add-ons for users, features, integrations.

Integration platforms, dev assistance, and premium support add up fast. You fund all infrastructure yourself.

[ InsuraTec Model ]

Transparent economics

Straightforward investment with transparent, all-in pricing, no surprise fees.

Competitive commission structure while building real business equity. Ownership + infrastructure = sustainable, transferable value.

[ Acquisition Model ]

Corporate owns your book

Corporate owns the book of business.

Corporate dashboards focused on corporate KPIs. Limited ability to extract data or take your book elsewhere.

[ Software-Only Model ]

You own it, platform limitations

You own all client data and book of business.

Data usually exportable (format varies). Analytics limited to whatever the platform provides.

[ InsuraTec Model ]

Your data, better tools

You own your data and book of business - we provide tools to leverage it.

Full data portability. Analytics that drive YOUR business decisions.

[ Acquisition Model ]

They own it

They own your business after purchase.

Corporate leadership makes strategic decisions, you operate under their branding, and you're locked in - you can't sell what you no longer own.

[ Software-Only Model ]

You own it, but not your identity

You own your business with complete autonomy and can sell anytime.

However, most agents end up using the IMO's or software platform's branding rather than building their own agency identity.

[ InsuraTec Model ]

You own everything

You own your business 100% - no equity stake, no buyout.

You make all strategic decisions, own your brand completely, can sell later (makes you MORE valuable), and keep your agency and book if you ever leave.

[ Acquisition Model ]

Corporate standard systems

Corporate standard systems (often legacy).

Limited customization due to IT standards, forced updates on corporate timeline.

[ Software-Only Model ]

Rigid platforms, patched solutions

Pre-built SaaS with very limited customization.

Need real functionality? Patch multiple solutions together (requires dev help, creates issues). Feature requests take 6-12+ months if they happen at all.

[ InsuraTec Model ]

Technology built around you

Purpose-built, flexible technology that adapts to your workflow.

When you need specific functionality for growth, we work with you to accommodate it. Open integration with support, managed updates with input.

[ Acquisition Model ]

Enterprise access, corporate control

Access enterprise carrier relationships with top-tier commission rates.

Corporate handles contracting but controls which carriers you can access based on corporate priorities.

[ Software-Only Model ]

Locked out of top carriers

Most top carriers won't appoint you, they require substantial production minimums, years of track record, and infrastructure small agencies don't have.

Even if appointed, you get lower rates and handle all contracting yourself.

[ InsuraTec Model ]

Enterprise access, your control

Enterprise-level contracts and commission rates through our combined production volume.

We meet carrier criteria so you don't have to, manage contracting with dedicated support, and expand relationships based on needs.

[ Acquisition Model ]

Comprehensive but standardized

Corporate compliance, back-office, marketing templates, recruiting programs, and IT help desk.

Thorough and efficient but standardized - not tailored to your needs.

[ Software-Only Model ]

You're on your own

You handle everything: compliance, back-office, marketing, recruiting, training.

Hire your own expertise or build it all from scratch. Only get vendor support for software (quality varies, premium costs extra).

[ InsuraTec Model ]

Tailored infrastructure support

Proactive compliance guidance, integrated back-office support, marketing infrastructure you can customize, recruiting and development support, and dedicated account assistance.

[ Acquisition Model ]

Corporate-driven growth

Recruit into corporate (agents join parent company).

Geographic expansion and product lines subject to corporate strategy. Corporate systems handle scale automatically but on their terms.

[ Software-Only Model ]

Total freedom, total responsibility

Complete freedom to recruit, expand, and add products.

However, you must establish carrier contracts, compliance, and infrastructure in each new market. More business means more admin you build yourself.

[ InsuraTec Model ]

Strategic growth with support

Build your team your way with infrastructure that supports growth.

Expand with carrier contracts and compliance already in place. Product flexibility with infrastructure support. Systems scale with you.

[ Acquisition Model ]

Upfront cash, limited long-term upside

They pay you at acquisition, but corporate takes larger commission share over time.

Wealth captured at sale - future depends on employment contract. Post-acquisition "efficiencies" often reduce income.

[ Software-Only Model ]

Low entry, hidden costs add up

Monthly subscription ($100-500+) plus add-ons for users, features, integrations.

Integration platforms, dev assistance, and premium support add up fast. You fund all infrastructure yourself.

[ InsuraTec Model ]

Transparent economics

Straightforward investment with transparent, all-in pricing, no surprise fees.

Competitive commission structure while building real business equity. Ownership + infrastructure = sustainable, transferable value.

[ Acquisition Model ]

Corporate owns your book

Corporate owns the book of business.

Corporate dashboards focused on corporate KPIs. Limited ability to extract data or take your book elsewhere.

[ Software-Only Model ]

You own it, platform limitations

You own all client data and book of business.

Data usually exportable (format varies). Analytics limited to whatever the platform provides.

[ InsuraTec Model ]

Your data, better tools

You own your data and book of business - we provide tools to leverage it.

Full data portability. Analytics that drive YOUR business decisions.

[ Build in-house ]

Massive investment, long timeline

Years to build and deploy. Initial investment many times higher than alternatives.

Requires a large internal dev team and continuous maintenance, updates, bug fixes, and security patches.

[ Off-the-shelf SaaS ]

Quick start, limited customization

Faster implementation with minimal technical team, vendor manages the platform.

However, very limited customization: basic configuration only, constrained by the vendor's product roadmap.

[ InsuraTec ]

Fast deployment, your brand

Rapid white-label deployment with predictable costs.

We manage all technology, maintenance, and updates, no technical team required on your end.

[ Build in-house ]

Complete control, complete responsibility

You own the code and IP with unlimited customization capability.

Platform branded to your carrier, and you can build whatever features you need if you have the resources.

[ Off-the-shelf SaaS ]

Vendor's brand, vendor's limitations

Vendor owns platform - you license it.

Agents see the software vendor's branding and platform identity, not yours. Submit feature tickets and hope - vendor prioritizes across all clients, not your needs.

[ InsuraTec ]

White-label flexibility

Your brand, our infrastructure.

Flexible customization to match your carrier requirements and workflows. Fully branded as your carrier technology - agents see YOUR brand. Collaboration to build what your agents need.

[ Build in-house ]

Full control, full cost

You create all training materials, programs, and onboarding infrastructure.

You staff support team 24/7 to handle all agent needs.

[ Off-the-shelf SaaS ]

Generic vendor support

Vendor provides generic training and standard onboarding process.

Vendor support quality varies - agents get software support, not carrier support.

[ InsuraTec ]

White-label carrier support

Co-branded training tailored to your carrier and products.

White-label support - we handle it but agents think it's coming from you. Carrier-specific onboarding that reinforces your brand and processes.

[ Build in-house ]

Perfect fit, enormous cost

Built exactly for your products, underwriting system, commission structure, compliance specifications, and policy administration.

Direct integration with all your systems.

[ Off-the-shelf SaaS ]

Generic platform, workarounds required

Generic platform may not support your specific product structures, underwriting rules, workflows, or commission processing.

May require middleware or patching to connect to your systems. Generic compliance may not address your specific requirements.

[ InsuraTec ]

Configured for you

Configured for your specific products, underwriting, and carrier workflows.

Integrated with your underwriting and policy administration systems. Tailored to your commission structure, hierarchy, and compliance needs.

[ Build in-house ]

Strong differentiation if executed well

High market differentiation with proprietary technology.

Strong agent recruitment advantage if well-executed. Technology can be competitive advantage for agent retention.

[ Off-the-shelf SaaS ]

Weak differentiation

Low market differentiation - same software other carriers might use.

Weak agent recruitment advantage - agents see it as generic software. Minimal impact on agent retention - just tools.

[ InsuraTec ]

Unique positioning

High market differentiation - white-label means it's uniquely yours.

Strong agent recruitment advantage - agents see sophisticated carrier technology. Positions you as tech-forward carrier supporting agent success.

[ Build in-house ]

You manage everything

You manage infrastructure scaling for new agents.

Requires development work for each new product launch. You build state-specific features for geographic expansion.

[ Off-the-shelf SaaS ]

Automatic but inflexible

Vendor scales automatically (you pay per seat).

Limited support for new product types - vendor may not adapt quickly. Generic platform may not handle state variations well.

[ InsuraTec ]

Scalable relationship

We handle all scaling infrastructure for new agents.

Flexible - we adapt to new products and programs quickly. We configure for state-specific requirements as you expand.

[ Build in-house ]

High risk, high sunk costs

High technology risk - if dev team leaves or project fails, you're stuck.

Your responsibility entirely for data security and business continuity. No vendor lock-in but sunk costs are enormous (millions invested).

[ Off-the-shelf SaaS ]

Vendor dependency

Medium technology risk with vendor lock-in.

Switching vendors means retraining all agents and rebuilding integrations. Data security is vendor's responsibility (compliance varies). Business continuity dependent on vendor's health.

[ InsuraTec ]

Built for the long haul

Low technology risk, we're invested in your success. Enterprise-level security we manage. Ongoing support and business continuity. Straightforward terms, no surprises.

[ Build in-house ]

Build in-house: 7-15x higher cost

Development costs alone far exceed working with us. Add ongoing maintenance and support infrastructure, total investment can be many times higher.

[ Off-the-shelf SaaS ]

2-4x cost, limited functionality

No development costs, but licensing fees accumulate significantly over time. Customisation limited or expensive. Your agents get vendor support, not carrier support.

[ InsuraTec ]

Full functionality, fraction of the cost

No development costs. Predictable pricing. Maintenance and customisation included. White-label support with seamless carrier experience.

Book a consultation and discover how InsuraTec can help you scale smarter, faster, and with confidence.

Get agents activated in days, not weeks.

Built-in logic ensures accuracy and confidence.

Seamless direct access without third-party hurdles.

Getting to know InsuraTec

InsuraTec is a technology driven insurance infrastructure platform built for agents, agencies, IMOs, and carriers. We bridge the gap between independence and scalability, offering tools that streamline recruiting, contracting, training, compliance, and data management all in one connected ecosystem.

Not at all. You keep full control of your brand, your identity, and your data. InsuraTec runs behind the scenes, powering your operations while you continue building your own reputation in the marketplace. Think of us as the engine, not the logo.

Most platforms force you to fit their model or to get acquired, losing your identity in the process. InsuraTec was built to flex around yours. It's designed for every level of growth including solo producers to national IMOs and companies within the United States financial sector. InsuraTec gives you tools that work with your existing systems instead of replacing them. You know your business and we provide the infrastructure you can leverage.

Yes. We've established strong relationships with respected life and health carriers across the United States, so you can access competitive contracts and products.

Yes. Our platform automates recruiting workflows, onboarding, and compliance tracking. We also offer structured training systems that help new agents ramp up quickly and seasoned ones scale efficiently.

Thank you!

We’ll get back

to you shortly

Our team will review

and get back to you

as soon as possible.

Seamless direct access without third-party hurdles.