Ecosystems, AI, Automation, Growth

The Human Side of Digital Transformation — Empowering Agents Through Technology

InsuraTec

October 31, 2025

3 min read

October 31, 2025

4 min read

by InsuraTec

The insurance industry doesn’t fear innovation — it fears non-compliance.

That’s because every system update, new data connection, or digital workflow has to live under the watchful eye of regulators. Whether it’s protecting consumer data or maintaining audit trails, insurers face a dual challenge: modernize or fall behind — but never break compliance while doing it.

For IMOs, agencies, and carriers still running on legacy infrastructure, that balance can feel impossible. But with the right approach, modernization can actually strengthen compliance instead of threatening it.

Legacy systems weren’t built for the regulatory complexity of modern insurance. When most of them were deployed decades ago, frameworks like GDPR, CCPA, and NAIC Model Privacy Regulations didn’t exist.

That means outdated infrastructure often hides invisible compliance gaps:

According to PwC, nearly 60 percent of insurers cite legacy systems as a direct barrier to meeting modern regulatory expectations. (PwC: Insurance Technology Trends)

It’s tempting to see compliance as a brake pedal, but in reality it’s a strategic accelerator when paired with the right modernization approach.

Deloitte notes that forward-thinking insurers are now embedding compliance checks into their digital workflows — using automation, audit logs, and real-time reporting to prevent errors before they happen. (Deloitte: Insurance Technology Trends)

Instead of being a reactive afterthought, compliance becomes a built-in feature of modern systems:

When compliance is part of the digital architecture, it stops being an obstacle — and starts being an advantage.

Many firms assume the only way to achieve compliance modernization is to replace their entire system. But that’s risky, expensive, and usually unnecessary.

A more strategic approach is modular modernization — wrapping legacy systems in secure, API-based layers that handle data exchange, permissions, and logging without altering the core system.

This approach effectively adds a compliance control tower over existing infrastructure, allowing insurers to stay agile while satisfying regulators, evolving safely, without sacrificing the proven systems that run their business.

As insurers begin using AI for underwriting, claims, and fraud detection, regulators are watching closely. Transparency and explainability will be key — not just accuracy.

McKinsey highlights that AI governance frameworks must ensure traceability, human oversight, and ethical accountability in decision-making. (McKinsey: AI in Insurance)

That means your systems need to do more than crunch numbers — they need to prove how those numbers were created.

Legacy infrastructure without strong metadata or documentation can’t meet that expectation without modernization.

At InsuraTec, we believe modernization should make compliance easier, not harder. Our technology gives IMOs, agencies, and carriers the infrastructure to stay audit-ready, secure, and regulator-friendly — without losing the systems that built their business.

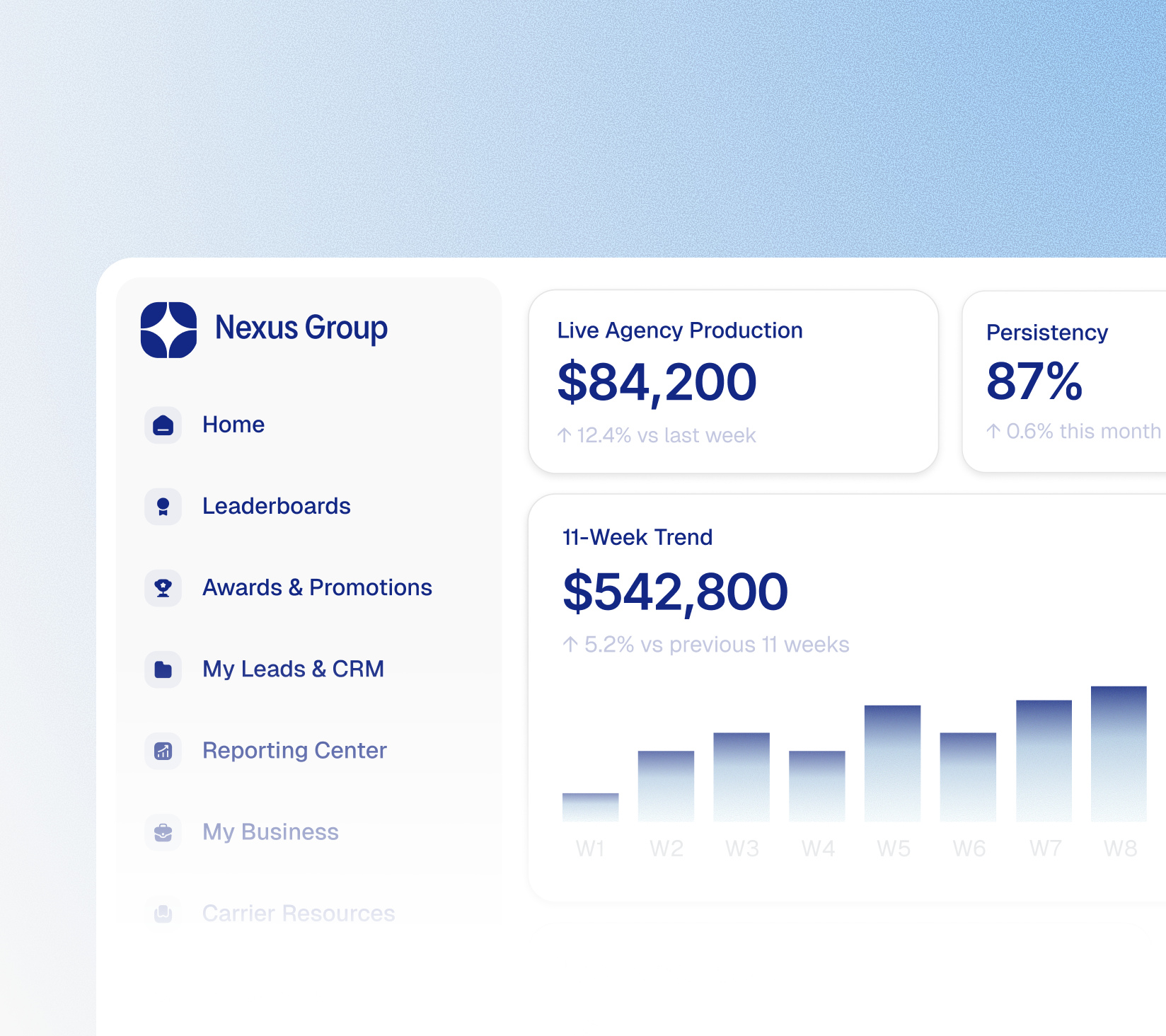

Platforms like MyInsuraTec, our customizable Business Management Solution, bring everything together in one compliant ecosystem. From secure data handling to role-based permissions and built-in audit tracking, partners gain full operational visibility — all under their brand, not ours.

And for consumer-facing compliance, MyPolicyInfo delivers transparency at scale. Clients can access their policy details, track application status, and connect directly with their agent — ensuring disclosures are consistent, documented, and always up to date.

Together, these tools form a living compliance framework — not static paperwork, but real-time infrastructure that supports accuracy, accountability, and trust.

Because in a world where regulations evolve faster than software cycles, staying compliant means staying connected.

InsuraTec builds the infrastructure that keeps both running smoothly.

Share this article

Newsletter

Subscribe to learn about new product features, the latest in insurance, solutions, and updates.

Thank you!

We’ll get back

to you shortly

Our team will review

and get back to you

as soon as possible.

Seamless direct access without third-party hurdles.