Ecosystems, Data

Regulation, Compliance & Legacy Tech: How to Stay Legal While You Transform

InsuraTec

October 31, 2025

4 min read

October 31, 2025

3 min read

by InsuraTec

For years, the narrative around insurance technology has centered on automation, algorithms, and AI. But the best tech doesn’t replace people — it empowers them.

In an industry built on relationships, digital transformation is only successful when it strengthens human connection.

At its best, technology should give agents more time to advise, more insight to act, and more visibility to grow. That’s the version of modernization that drives the future of insurance — and it’s the one InsuraTec was built to deliver.

Legacy systems weren’t designed for how modern agents work. Most are clunky, fragmented, and slow — demanding hours of data entry or manual tracking. The result? Agents spend more time wrestling software than helping clients.

A 2024 McKinsey survey found that nearly 70 percent of insurance professionals say legacy tools directly limit their productivity. (McKinsey)

Meanwhile, IMOs and agency leaders face their own frustration: inconsistent data, limited visibility, and no unified view of performance. The tech meant to streamline business has become the thing holding it back.

That’s not transformation — that’s digital fatigue.

Real transformation happens when technology disappears into the background — when it supports how people already work instead of forcing them to adapt.

Modern insurance infrastructure gives agents:

According to Deloitte, insurers that invest in human-centered digital platforms see a 25 percent boost in productivity and higher long-term retention. (Deloitte)

That’s the power of infrastructure designed for people, not just processes.

Technology can’t sell a policy, lead a team, or motivate someone through rejection — but it can make all of those things easier.

When agents have clarity — when they can see their numbers, manage their pipelines, and access client data instantly — confidence goes up. And confidence is contagious.

High-performing agencies aren’t just better equipped; they’re better connected. That’s what keeps culture strong, even as organizations scale.

At InsuraTec, we don’t believe in replacing people with platforms. We believe in giving people the tools to perform at their best and reclaim their time.

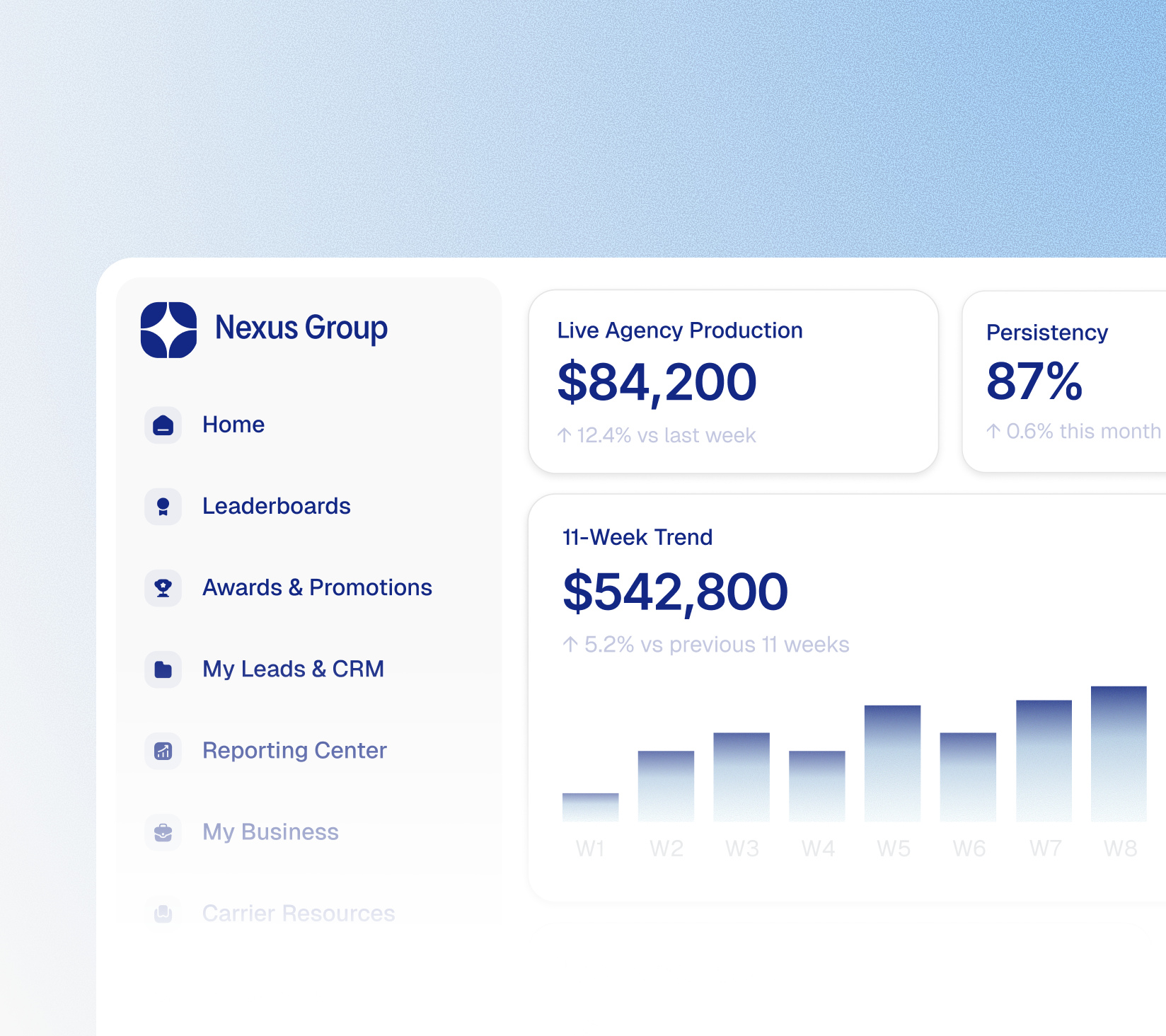

Our MyInsuraTec Business Management Solution gives agents and IMOs a single place to manage growth — from lead tracking and communication to production analytics and compliance visibility. It’s everything they need to work smarter, not harder.

For clients and carriers, MyPolicyInfo delivers the same level of transparency. Policyholders can view their coverage, track updates, and contact their agent directly — building trust through clarity and communication.

Technology doesn’t replace great agents. It reveals just how powerful they can be.

Share this article

Newsletter

Subscribe to learn about new product features, the latest in insurance, solutions, and updates.

Thank you!

We’ll get back

to you shortly

Our team will review

and get back to you

as soon as possible.

Seamless direct access without third-party hurdles.