Ecosystems, AI, Automation, Growth

The Human Side of Digital Transformation — Empowering Agents Through Technology

InsuraTec

October 31, 2025

3 min read

October 31, 2025

5 min read

by InsuraTec

The line between “insurance company” and “technology company” is blurring fast. The next big wave isn’t about selling more policies — it’s about embedding insurance directly into the products and experiences people already use.

Imagine buying a new car and automatically getting personalized coverage in the checkout flow. Or booking a trip and having travel insurance included seamlessly, without a single form. That’s embedded insurance, and it’s rewriting the rules of distribution.

Analysts at InsurTech Global Outlook call it the most disruptive model since online comparison portals. (Capgemini) But here’s the catch: Most insurers are still running on legacy systems that weren’t designed for this kind of agility.

Embedded insurance integrates coverage directly into non-insurance customer journeys. It’s powered by APIs (application programming interfaces) that let insurers connect their products to retail, travel, banking, or mobility platforms.

Instead of selling insurance as a separate step, it becomes an invisible value-add. Think:

It’s a frictionless, contextual experience — insurance where people are, not where we wish they’d go.

McKinsey & Company predicts that embedded insurance could account for up to $700 billion in global gross written premiums by 2030. (McKinsey)

That’s not a trend. That’s a tectonic shift.

Embedded models depend on speed, flexibility, and real-time integration — the exact opposite of what most legacy systems offer.

Old core systems are monolithic by design. They require batch updates, manual file transfers, and siloed databases that make real-time APIs nearly impossible. According to Deloitte, more than half of insurers admit their systems “limit innovation capacity” due to integration challenges. (Deloitte)

When a partner platform expects instant quotes or real-time policy issuance, a legacy backend simply can’t respond fast enough. The result? Missed partnership opportunities, delayed deals, and lost market share to digital-first competitors.

The irony is that legacy systems aren’t “bad” — they’re just not built for the kind of dynamic data flow that embedded insurance demands.

The good news? You don’t have to bulldoze your tech stack to play in the embedded space. You just need to wrap your legacy system in an API-first layer.

This “middleware bridge” lets modern apps talk to old systems without disrupting mission-critical operations. Insurers can gradually shift functions — quoting, policy issuance, payments — into modular services while the old core quietly hums in the background.

It’s a strategy known as progressive modernization, and it’s gaining momentum. A Gartner report found that insurers using this approach achieve 30–50% faster time-to-market compared to full system overhauls. (Gartner via Forbes Tech Council)

This approach also lowers risk: if a new API or digital partner fails, your core system remains stable — the perfect balance of innovation and control.

Embedded insurance isn’t just about convenience — it’s the foundation of a broader ecosystem economy.

Platforms that sell insurance at the right moment can collect richer data on behavior, usage, and preferences. That data loops back into underwriting, enabling more accurate risk pricing and personalized coverage.

For example:

According to Accenture, insurers who partner within digital ecosystems could see revenue growth up to five times faster than traditional players by 2030. (Accenture)

Embedded insurance isn’t just a sales strategy. It’s a data strategy.

With great connectivity comes great complexity. Insurers diving into embedded models face several hurdles:

The solution? A layered approach — modern wrappers, policy orchestration tools, and standardized data exchanges — built with compliance and brand clarity baked in from day one.

The future of insurance technology isn’t about who owns the platform — it’s about who benefits from it.

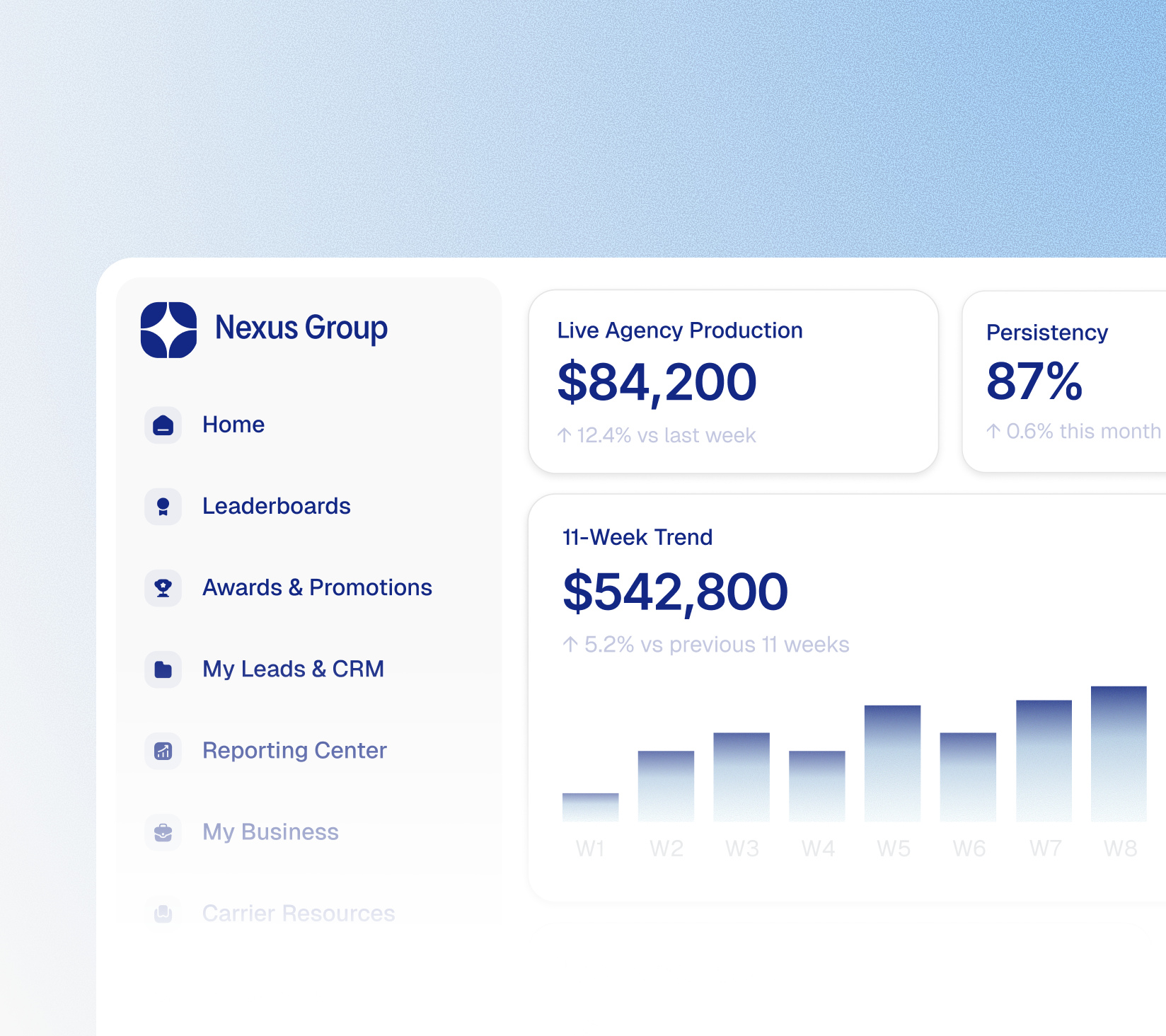

MyInsuraTec was designed to be the last business management tool you’ll ever need — a single, secure ecosystem where agencies, IMOs, and carriers can modernize operations without sacrificing their brand identity.

We believe legacy systems shouldn’t hold great companies back, and modernization shouldn’t come at the cost of independence. That’s why InsuraTec builds technology under your brand, not ours. We don’t acquire. We empower.

From real-time visibility into production and commissions to integrated communication and client management, MyInsuraTec gives partners everything they need to scale — powered by our infrastructure, presented under their name.

Embedded insurance may be the next frontier — but at InsuraTec, we’re making sure every partner gets to chart their own course.

Share this article

Newsletter

Subscribe to learn about new product features, the latest in insurance, solutions, and updates.

Thank you!

We’ll get back

to you shortly

Our team will review

and get back to you

as soon as possible.

Seamless direct access without third-party hurdles.